Low Gas Prices Slow Local Sales Tax Revenue

By Eric Malanoski (Townsquare Media News)

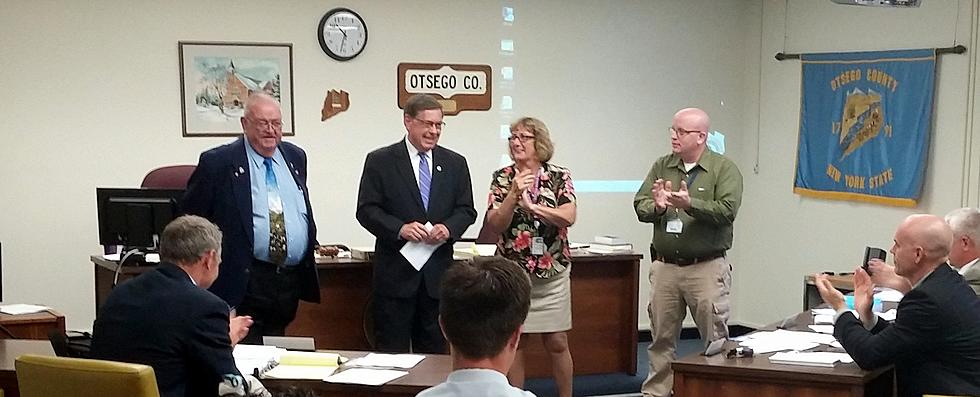

Local sales tax collections across New York state only grew 1.7 percent in the first six months of 2016, according to a report released today by State Comptroller Thomas P. DiNapoli. Overall, growth slowed from 2.6 percent in the first quarter to 0.8 percent in the second quarter.

“While statewide sales tax revenues continue to rebound slowly, only some parts of the state are seeing growth,” DiNapoli said. “The slowdown in sales tax collection growth reflects a three-year trend. Collections trickle in the first half of the year, followed by more robust growth in the second half. And recent economic projections suggest that sales tax collections will pick up again in the second half of 2016.”

While total local sales tax collections grew by $130 million, regional growth was uneven across the state. The Mid-Hudson region had the strongest growth at 2.7 percent, followed by the Finger Lakes at 2.5 percent and New York City at 2.4 percent.

In the first half of 2016, collections declined in the Central New York region by 1.3 percent, in the Western New York region by 0.7 percent and in the North Country by 0.1 percent over the same period last year.

Local sales tax collections were generally lower, due in part to lower gasoline and diesel fuel prices. Since mid-year 2014, local gas and diesel fuels tax collections are down $156 million. In 2006, counties had the option to switch to a flat “cents per gallon” tax, as the state changed from a four percent tax rate to a flat eight cents per gallon tax. However, all counties except Seneca County continue to use the prior method of “local percentage of sales,” resulting in this significant loss of local revenues.

On a county-specific basis, sales tax collections grew in 34 of the 57 counties outside of New York City, with the strongest growth in Chautauqua County at 11.6 percent, due to an increase in the county’s rate from 3.5 to 4 percent. Putnam County and Yates County also saw strong growth, at 11.5 and 7.8 percent, respectively.

The steepest of the declines in 23 counties were seen in Hamilton (6.8 percent), Washington (6.4 percent) and Cattaraugus (6 percent) counties.

New York City’s sales tax collections grew by $80 million in the first half of 2016, which accounts for the majority of local sales tax growth statewide.

Of the 16 other cities in New York state with their own general sales tax, 11 had increases. Yonkers had the largest growth at 17.3 percent due to an increase in the local sales tax rate from 4 to 4.5 percent as of September, 2015. Norwich saw a 5.9 percent increase, followed by Johnstown with a 5.7 percent rise. Five cities experienced declines, including Gloversville (5.1 percent), Olean (3.8 percent) and Salamanca (3 percent).

To read the report, go to: http://www.osc.state.ny.us/localgov/pubs/research/localsalestaxcollections0816.pdf

More From WDOS-WDLA-WCHN CNY News